8.3 Health Care Funding

Health care costs impact both macroeconomics (affecting the entire country and society as a whole) and microeconomics (affecting the financial decisions of businesses and individuals). Health care services are funded by several payment models, including federal government programs (e.g., Medicare and Medicaid), private health insurance (typically provided by employers), and self-pay. Payment models also impact services provided by health care agencies, as well as the services and medications available to consumers. Nurses must be aware of these payment models because of the impact on the allocation of resources they need to provide client care.

Government Funding

Medicare and Medicaid were signed into law in 1965. These programs provide eligible Americans support for their health care needs with taxpayer funding.

Medicare

Medicare is a federal health insurance program used by people aged 65 and older, younger individuals with permanent disabilities, and people with end-stage renal disease requiring dialysis or kidney transplantation. Medicare coverage has four possible components: Part A, Part B, Part C, and Part D.[1] See Figure 8.5[2] for an infographic illustrating Medicare Parts A, B, C, and D.

- Part A (Hospital Insurance): Part A covers clients’ hospital stays, skilled nursing facility care, hospice care, and some home health care. Part A is free for clients if they or their spouse paid Medicare taxes for a specific amount of time while working. If clients are not eligible for free coverage, they can buy it with premiums based on the number of months they paid Medicare taxes.

- Part B (Medical Insurance): Part B covers doctors’ services, outpatient care, medical supplies, and preventative care services. Most people pay a standard premium for Part B.

- Part C (Medicare Advantage Plan): A Medicare Advantage Plan is a health plan choice offered by private companies approved by Medicare, also referred to as “Part C.” These plans provide Part A and Part B coverage, and most also include Part D coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs.

- Part D (Prescription Drug Coverage): Part D helps cover the cost of prescription drugs and vaccinations. To get Medicare drug coverage, clients must enroll in a Medicare-approved plan that offers drug coverage. Different plans vary in cost and what prescription medications they cover, also referred to as a formulary.

Read more about Medicare at medicare.gov.

Medicaid

Medicaid is the largest source of health coverage in the United States. It is a joint federal and state program covering eligible individuals with taxpayer funding. To participate in Medicaid, federal law requires states to cover certain groups of individuals, such as low-income families, qualified pregnant women and children, and individuals receiving Supplemental Security Income (SSI). States may choose to cover additional groups, such as individuals receiving home and community-based services and children in foster care who are not otherwise eligible.[3]

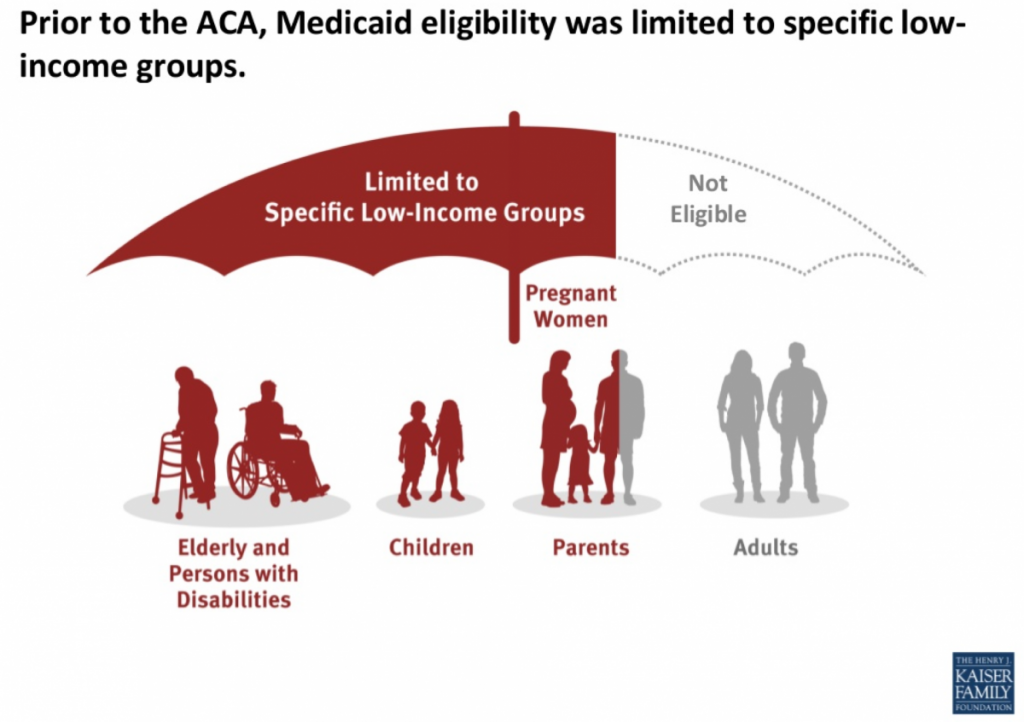

In 2014 the Affordable Care Act expanded Medicaid to cover all low-income Americans under the age of 65 years and also expanded coverage for children. Due to the individual states’ involvement in Medicaid, coverage of services varies from state to state.[4] See Figure 8.6[5] for an illustration of Medicaid-eligible populations.

Individuals with Medicaid plans have support in paying for a variety of health services, including hospital care, laboratory and diagnostic testing, skilled nursing care, home health services, preventative care, and regular outpatient provider visits.

Other Government Health Funding

There are several other types of health coverage provided by federal and state programs. Read more about these programs in the following box.

Other Federal and State Health Care Funding Programs[6]

- State Children’s Health Insurance Program (CHIP): A program designed to help provide coverage for uninsured children whose family income is below average but too high to qualify for Medicaid. The federal government provides matching funds to states for health insurance for these families.

Read more details at InsuredKidsNow.gov.

- Children and Youth With Special Health Care Needs: This program coordinates funding and resources to provide care to people with special health needs.

Read more details at Children With Special Health Care Needs.

- Tricare: This program covers about 9 million active duty and retired military personnel and their families.

Read more details at TRICARE.

- Veterans Health Administration (VHA): This government-operated health care system provides comprehensive health services to eligible military veterans. About 9 million veterans are enrolled.

Read more details at Veterans Health Administration.

- Indian Health Service: This system of government hospitals and clinics provides health services to about 2 million Native Americans living on or near a reservation.

Read more details at Indian Health Service.

- Federal Employee Health Benefits (FEHB) Program: This program allows private insurers to offer insurance plans within guidelines set by the government for the benefit of active and retired federal employees and their survivors.

Read more details at The Federal Employees Health Benefits (FEHB) Program.

- Refugee Health Promotion Program: This program provides short-term health insurance to newly arrived refugees.

Read more details at Refugee Health Promotion Program (RHP).

Private Insurance

Individuals who are not eligible for government-funded health programs like Medicare or Medicaid can purchase private health insurance. Many individuals with private insurance obtain coverage through their employers’ benefit packages, where the costs for coverage are shared between the employer and the employee. If an individual does not receive health insurance through their employer, they may purchase it from the Marketplace established by the Affordable Care Act.

Read more about obtaining health insurance through the ACA Marketplace at healthcare.gov.

Self-Pay

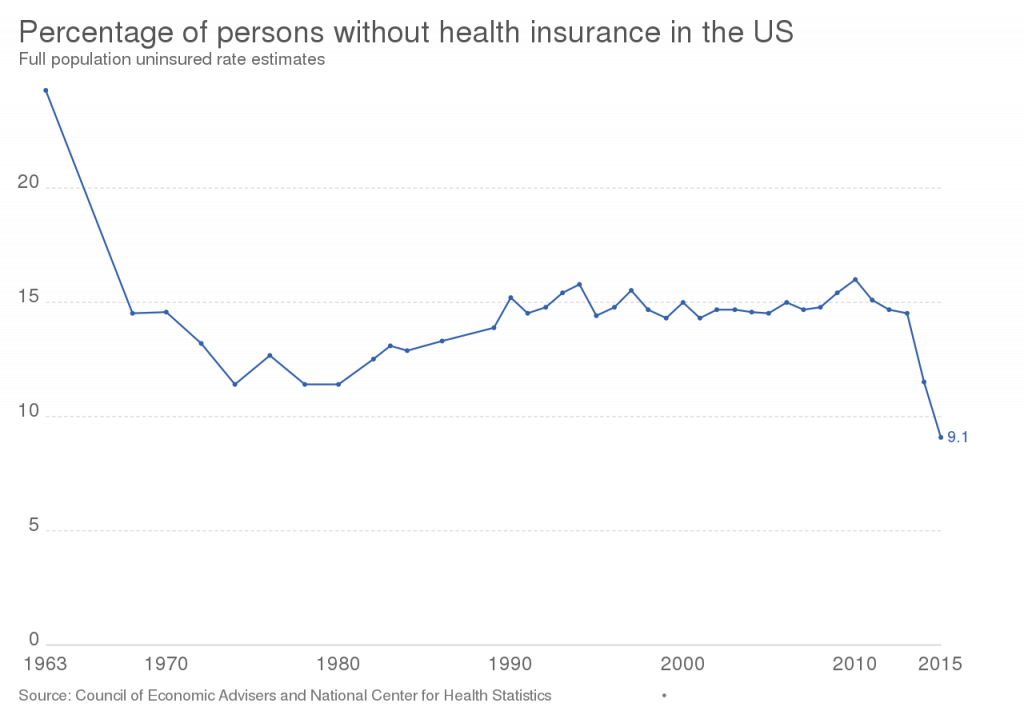

Some individuals do not have health care coverage provided by their employer, do not qualify for Medicare or Medicaid, and do not elect to purchase health insurance coverage. Instead, these individuals go without coverage and pay health care costs as they arise. See Figure 8.7[7] for a graph illustrating the decreasing numbers of uninsured consumers in the United States over the past several decades. Unfortunately, due to the skyrocketing cost of health care services, significant bills can accrue from a single serious illness or traumatic injury that can put consumers without health care coverage in jeopardy of bankruptcy. Nurses can assist uninsured individuals to better understand coverage options by referring them to a case manager or social worker.

Types of Insurance Coverage

Health insurance plans have different types of coverage. Common types of health insurance plans are HMO, PPO, POS, HDHP, or HSA.

- Health Maintenance Organization (HMO): HMO plans usually have the lowest monthly cost for coverage (i.e., premium) but also have a smaller network of providers and hospitals where the consumer may receive insured care. This means the consumer is restricted to receive care only from specific providers and health facilities. Many HMOs also require the consumer to see their primary care provider to request a referral to see a specialist, which may or may not be approved by the HMO. Additionally, many tests, procedures, surgeries, and medications require “preauthorization” by the HMO, which may or may not be approved. Due to these restrictions, consumers may find they sacrifice flexibility and choice for lower cost of coverage.[8]

- Preferred Provider Organization (PPO): PPO plans are typically less restrictive than HMOs. PPOs typically include “in-network” providers and hospitals where costs are lower if care is received in-network, but consumers also have a choice to receive “out-of-network” care at a higher cost. Referrals from a primary care provider are not generally required in a PPO. The monthly premium for a PPO plan is typically higher than an HMO plan, but PPOs allow more consumer flexibility in choosing their health care providers.[9]

- Point of Service (POS): POS plans are a combination of HMO and PPO plans, where the insured consumer has a preferred provider network to receive health care services at a lower cost, but also has the flexibility to receive care outside of their network. When consumers venture outside of the network, they often have to pay a significant share of the cost.[10]

- High Deductible Health Plan (HDHP): HDHP plans are often popular for younger individuals without chronic health care needs who spend little on health care but require coverage in the event a high-cost injury or illness occurs. HDHPs typically have lower monthly premiums but require the individual to pay more upfront for health care services before the coverage kicks in (referred to as a “deductible”). Individuals with an HDHP often have an associated Health Savings Account (HSA). HDHPs have grown in popularity as more employers offer these plans in an attempt to contain health care costs by shifting more cost-sharing to the consumer.

- Health Savings Account (HSA): An HSA is a special account reserved for eligible medical expenses with strict usage rules. Money placed in an HSA can often be deducted from a consumer’s pretaxed pay, resulting in tax savings. In addition to purchasing items like glasses, contacts, and over-the-counter medications, HSAs can often be used to pay for deductibles. Some employers deposit a specified amount of money into an employee’s HSA every year to help reimburse high deductibles.

Deductible and Copays

Costs paid by an insured individual are commonly referred to as “out-of-pocket expenses.” Out-of-pocket expenses include deductibles and co-pays. A deductible is the amount of money a consumer pays before the health care plan pays anything. Deductibles generally apply per person per calendar year. Typically, a PPO has higher premiums but lower deductibles than a HDHP.

A co-pay is a flat fee the consumer pays at the time of the health care service. For example, when visiting a primary provider, the consumer may pay $20 to the provider at each visit as a co-pay. Some health care plans require co-pays in addition to deductibles.

Nursing Considerations

Understanding a client’s health insurance coverage is important because it may impact their choice of health services and their ability to purchase medications and other supplies. Additionally, if a client is self-pay, it is helpful to refer them to resources such as case managers, social workers, or the financial department of the agency. These resources can assist them in obtaining affordable health care coverage through the ACA Marketplace or other government programs.

- Medicare.gov. What’s Medicare? https://www.medicare.gov/what-medicare-covers/your-medicare-coverage-choices/whats-medicare ↵

- “Understanding_of_medicare.png” by Samreen Al is licensed under CC BY-SA 4.0 ↵

- Medicaid.gov. Eligibility. https://www.medicaid.gov/medicaid/eligibility/index.html ↵

- Healthcare.gov. Affordable Care Act. https://www.healthcare.gov/glossary/affordable-care-act/ ↵

- “Medicaid.expansion-1200x846.png” by KFF is licensed under CC BY-NC-ND 4.0 ↵

- Schreck, R. I. (2020). Overview of health care financing. Merck Manual Consumer Version. https://www.merckmanuals.com/home/fundamentals/financial-issues-in-health-care/overview-of-health-care-financing ↵

- “Percentage_of_persons_without_health_insurance_in_the_US,_OWID.svg” by Our World In Data is licensed under CC BY 3.0 ↵

- Healthcare.gov (2024). How to pick a health insurance plan. https://www.healthcare.gov/choose-a-plan/plan-types/#top ↵

- Healthcare.gov (2024). How to pick a health insurance plan. https://www.healthcare.gov/choose-a-plan/plan-types/#top ↵

- Healthcare.gov (2024). How to pick a health insurance plan. https://www.healthcare.gov/choose-a-plan/plan-types/#top ↵

A federal health insurance program used by people aged 65 and older, younger individuals with permanent disabilities, and people with end-stage renal disease requiring dialysis or a kidney transplant.

A joint federal and state program covering eligible individuals with taxpayer funding.To participate in Medicaid, federal law requires states to cover certain groups of individuals, such as low-income families, qualified pregnant women and children, and individuals receiving Supplemental Security Income (SSI). States may choose to cover additional groups, such as individuals receiving home and community-based services and children in foster care who are not otherwise eligible.

The amount of money a consumer pays for health care before their insurance plan pays anything. Deductibles generally apply per person per calendar year.

A flat fee the consumer pays at the time of receiving a health care service as a part of their health care plan.