6 Globalizing the Value Proposition

Managers sometimes assume that what works in their home country will work just as well in another part of the world. They take the same product, the same advertising campaign, even the same brand names and packaging, and expect instant success. The result in most cases is failure. Why? Because the assumption that one approach works everywhere fails to consider the complex mosaic of differences that exists between countries and cultures.

Of course, marketing a standardized product with the same positioning and communications strategy around the globe—the purest form of aggregation—has considerable attraction because of its cost-effectiveness and simplicity. It is also extremely dangerous, however. Simply assuming that foreign customers will respond positively to an existing product can lead to costly failure. Consider the following classic examples of failure:

- Coca-Cola had to withdraw its 2-liter bottle in Spain after discovering that few Spaniards owned refrigerators with large enough compartments to accommodate it.

- General Foods squandered millions trying to introduce packaged cake mixes to Japanese consumers. The company failed to note that only 3% of Japanese homes were equipped with ovens.

- General Foods’ Tang initially failed in France because it was positioned as a substitute for orange juice at breakfast. The French drink little orange juice and almost none at breakfast.

With a few exceptions, the idea of an identical, fully standardized global value proposition is a myth, and few industries are truly global. How to adapt a value proposition in the most effective manner is therefore a key strategic issue.

6.1 Value Proposition Adaptation Decisions

Value proposition adaptationModification of a product or service to meet the physical, social, or mandatory requirements of a new market. deals with a whole range of issues, ranging from the quality and appearance of products to materials, processing, production equipment, packaging, and style. A product may have to be adapted to meet the physical, social, or mandatory requirements of a new market. It may have to be modified to conform to government regulations or to operate effectively in country-specific geographic and climatic conditions. Or it may be redesigned or repackaged to meet the diverse buyer preferences or standard-of-living conditions. A product’s size and packaging may also have to be modified to facilitate shipment or to conform to possible differences in engineering or design standards in a country or in regional markets. Other dimensions of value proposition adaptation include changes in brand name, color, size, taste, design, style, features, materials, warranties, after-sale service, technological sophistication, and performance.

The need for some changes, such as accommodating different electricity requirements, will be obvious. Others may require in-depth analysis of societal customs and cultures, the local economy, technological sophistication of people living in the country, customers’ purchasing power, and purchasing behavior. Legal, economic, political, technological, and climatic requirements of a country market may all dictate some level of localization or adaptation.

As tariff barriers (tariffs, duties, and quotas) are gradually reduced around the world in accordance with World Trade Organization (WTO) rules, other nontariff barriers, such as product standards, are proliferating. For example, consider regulations for food additives. Many of the United States’ “generally recognized as safe” (GRAS) additives are banned today in foreign countries. In marketing abroad, documentation is important not only for the amount of additive but also for its source, and often additives must be listed on the label of ingredients. As a result, product labeling and packaging must often be adapted to comply with another country’s legal and environmental requirements.

Many kinds of equipment must be engineered in the metric systemAn internationally-accepted decimalised system of measurement for units of force, weight, volume, and density. for integration with other pieces of equipment or for compliance with the standards of a given country. The United States is virtually alone in its adherence to a nonmetric system, and U.S. firms that compete successfully in the global market have found metric measurement to be an important detail in selling to overseas customers. Even instruction or maintenance manuals, for example, should be made available in centimeters, weights in grams or kilos, and temperatures in degrees Celsius.

Many products must be adapted to local geographic and climatic conditions. Factors such as topography, humidity, and energy costs can affect the performance of a product or even define its use in a foreign market. The cost of petroleum products, along with a country’s infrastructure, for example, may mandate the need to develop products with a greater level of energy efficiency. Hot, dusty climates of countries in the Middle East and other emerging markets may force automakers to adapt automobiles with different types of filters and clutch systems than those used in North America, Japan, and European countries. Even shampoo and cosmetic product makers have to chemically reformulate their products to make them more suited for people living in hot, humid climates.

The availability, performance, and level of sophistication of a commercial infrastructure will also warrant a need for adaptation or localization of products. For example, a company may decide not to market its line of frozen food items in countries where retailers do not have adequate freezer space. Instead, it may choose to develop dehydrated products for such markets. Size of packaging, material used in packaging, before- and after-sale service, and warranties may have to be adapted in view of the scope and level of service provided by the distribution structure in the country markets targeted. In the event that postsale servicing facilities are conspicuous by their absence, companies may need to offer simpler, more robust products in overseas markets to reduce the need for maintenance and repairs.

Differences in buyer preferences are also major drivers behind value proposition adaptation. Local customs, such as religion or the use of leisure time, may affect market acceptance. The sensory impact of a product, such as taste or its visual impression, may also be a critical factor. The Japanese consumer’s desire for beautiful packaging, for example, has led many U.S. companies to redesign cartons and packages specifically for this market. At the same time, to make purchasing mass-marketed consumer products more affordable in lesser developed countries, makers of products such as razor blades, cigarettes, chewing gum, ball-point pens, and candy bars repackage them in small, single units rather than multiple units prevalent in the developed and more advanced economies.

Expectations about product guarantees may also vary from country to country depending on the level of development, competitive practices, and degree of activism by consumer groups; local standards of production quality; and prevalent product usage patterns. Strong warranties may be required to break into a new market, especially if the company is an unknown supplier. In other cases, warranties similar to those in the home country market may not be expected.

As a general rule, packaging design should be based on customer needs. For industrial products, packaging is primarily functional and should reflect needs for storage, transportation, protection, preservation, reuse, and so on. For consumer products, packaging has additional functionality and should be protective, informative, appealing, conform to legal requirements, and reflect buying habits (e.g., Americans tend to shop less frequently than Europeans, so larger sizes are more popular in the United States).

In analyzing adaptation requirements, careful attention to cultural differences between the target customers in the home country (country of origin) and those in the host country is extremely important. The greater the cultural differences between the two target markets, the greater the need for adaptation. Cultural considerations and customs may influence branding, labeling, and package considerations. Certain colors used on labels and packages may be found unattractive or offensive. Red, for example, stands for good luck and fortune in China and parts of Africa; aggression, danger, or warning in Europe, America, Australia, and New Zealand; masculinity in parts of Europe; mourning (dark red) in the Ivory Coast; and death in Turkey. Blue denotes immortality in Iran, while purple denotes mourning in Brazil and is a symbol of expense in some Asian cultures. Green is associated with high tech in Japan, luck in the Middle East, connotes death in South America and countries with dense jungle areas, and is a forbidden color in Indonesia. Yellow is associated with femininity in the United States and many other countries but denotes mourning in Mexico and strength and reliability in Saudi Arabia. Finally, black is used to signal mourning, as well as style and elegance, in most Western nations, but it stands for trust and quality in China, while white—the symbol for cleanliness and purity in the West—denotes mourning in Japan and some other Far Eastern nations.

A country’s standard of living and the target market’s purchasing power can also determine whether a company needs to modify its value proposition. The level of income, the level of education, and the availability of energy are all factors that help predict the acceptance of a product in a foreign market. In countries with a lower level of purchasing power, a manufacturer may find a market for less-sophisticated product models or products that are obsolete in developed nations. Certain high-technology products are inappropriate in some countries, not only because of their cost but also because of their function. For example, a computerized, industrial washing machine might replace workers in a country where employment is a high priority. In addition, these products may need a level of servicing that is unavailable in some countries.

When potential customers have limited purchasing power, companies may need to develop an entirely new product designed to address the market opportunity at a price point that is within the reach of a potential target market. Conversely, companies in lesser-developed countries that have achieved local success may find it necessary to adopt an “up-market strategyUsed by firms when positioning a local product in global markets where products must meet world-class standards.” whereby the product may have to be designed to meet world-class standards.

Minicase: Kraft Reformulates Oreo Cookies in ChinaJargon (2008, May 1).

Kraft’s Oreo has long been the top-selling cookie in the U.S. market, but the company had to reinvent it to make it sell in China. Unlike their American counterparts, Oreo cookies sold in China are long, thin, four-layered, and coated in chocolate.

Oreos were first introduced in 1912 in the United States, but it was not until 1996 that Kraft introduced Oreos to Chinese consumers. After more than 5 years of flat sales, the company embarked on a complete makeover. Research had shown, among other findings, that traditional Oreos were too sweet for Chinese tastes and that packages of 14 Oreos priced at 72 cents were too expensive. In response, Kraft developed and tested 20 prototypes of reduced-sugar Oreos with Chinese consumers before settling on a new formula; it also introduced packages containing fewer Oreos for just 29 cents.

But Kraft did not stop there. The research team had also picked up on China’s growing thirst for milk, which Kraft had not considered before. It noted that increased milk demand in China and other developing markets was a contributing factor to higher milk prices around the world. This put pressure on food manufacturers like Kraft, whose biggest business is cheese, but it also spelled opportunity.

Kraft began a grassroots marketing campaign to educate Chinese consumers about the American tradition of pairing milk with cookies. The company created an Oreo apprentice program at 30 Chinese universities that drew 6,000 student applications. Three hundred were accepted and trained as Oreo-brand ambassadors. Some of them rode around Beijing on bicycles, outfitted with wheel covers resembling Oreos, and handed out cookies to more than 300,000 consumers. Others organized Oreo-themed basketball games to reinforce the idea of dunking cookies in milk. Television commercials showed kids twisting apart Oreo cookies, licking the cream center, and dipping the chocolate cookie halves into glasses of milk.

Still, Kraft realized it needed to do more than just tweak its recipe to capture a bigger share of the Chinese biscuit market. China’s cookie-wafer segment was growing faster than the traditional biscuit-like cookie segment, and Kraft needed to catch up to rival Nestlé SA, the world’s largest food company, which had introduced chocolate-covered wafers there in 1998.

So Kraft decided this market opportunity was big enough to justify a complete remake of the Oreo itself and, departing from longstanding corporate policy for the first time, created an Oreo that looked almost nothing like the original. The new Chinese Oreo consisted of four layers of crispy wafer filled with vanilla and chocolate cream, coated in chocolate. To ensure that the chocolate product could be shipped across the country, could withstand the cold climate in the north and the hot, humid weather in the south, and would still melt in the mouth, the company had to develop a new proprietary handling process.

Kraft’s adaptation efforts paid off. In 2006, Oreo wafer sticks became the best-selling biscuit in China, outpacing HaoChiDian, a biscuit brand made by the Chinese company Dali. The new Oreos also outsell traditional (round) Oreos in China. They also have created opportunities for further aggregation and product innovation. Kraft now sells the wafers elsewhere in Asia, as well as in Australia and Canada, and the company has introduced another new product in China: wafer rolls, a tube-shaped wafer lined with cream. The hollow cookie can be used as a straw through which to drink milk.

This success encouraged Kraft to empower managers in other businesses around the globe. For example, to take advantage of the European preference for dark chocolate, Kraft introduced dark chocolate in Germany under its Milka brand. Research showed that Russian consumers like premium instant coffee, so Kraft positioned its Carte Noire freeze-dried coffee as an upscale brand. And in the Philippines, where iced tea is popular, Kraft launched iced-tea-flavored Tang.

As Kraft’s experience shows, successful global marketing and branding is rooted in a careful blend of aggregation, adaptation, and arbitrage strategies that is tailored to the specific needs and preferences of a particular region or country.

6.2 Adaptation or Aggregation: The Value Proposition Globalization Matrix

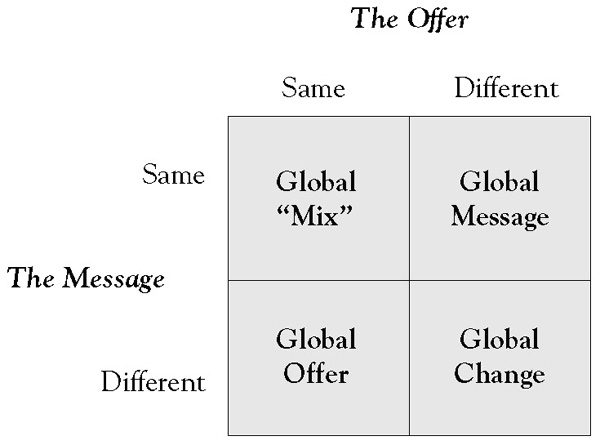

A useful construct for analyzing the need to adapt the offer and message (positioning) dimensions is the value proposition globalization matrixA construct for analyzing the need to adapt the offer and message (positioning) dimensions. shown in Figure 6.1 “The Value Proposition Globalization Matrix”, which illustrates four generic global strategies:

- A pure aggregation approach (also sometimes referred to as a “global marketing mix” strategy) under which both the offer and the message are the same

- An approach characterized by an identical offer (product/service aggregation) but different positioning (message adaptation) around the world (also called a “global offer” strategy)

- An approach under which the offer might be different in various parts of the world (product adaptation) but where the message is the same (message aggregation; also referred to as a “global message” strategy)

- A “global change” strategy under which both the offer and the message are adapted to local market circumstances

Figure 6.1 The Value Proposition Globalization Matrix

Global mix or pure aggregation strategiesValue proposition strategies that can be used in global markets. are relatively rare because only a few industries are truly global in all respects. They apply (a) when a product’s usage patterns and brand potential are homogeneous on a global scale, (b) when scale and scope cost advantages substantially outweigh the benefits of partial or full adaptation, and (c) when competitive circumstances are such that a long-term, sustainable advantage can be secured using a standardized approach. The best examples are found in industrial product categories such as basic electronic components or certain commodity markets.

Global offer strategiesStrategies that allow the same value proposition offer to be advantageously positioned differently in different parts of the world. are feasible when the same offer can be advantageously positioned differently in different parts of the world. There are several reasons for considering differential positioning. When fixed costs associated with the offer are high, when key core benefits offered are identical, and when there are natural market boundaries, adapting the message for stronger local advantage is tempting. Although such strategies increase local promotional budgets, they give country managers a degree of flexibility in positioning the product or service for maximum local advantage. The primary disadvantage associated with this type of strategy is that it could be difficult to sustain or even dangerous in the long term as customers become increasingly global in their outlook and confused by the different messages in different parts of the world.

Minicase: Starwood’s Branding in ChinaPalmeri and Balfour (2009, September 7).

Check into a Four Points Hotel by Sheraton in Shanghai and you will get all the perks of a quality international hotel: a free Internet connection, several in-house restaurants, a mah-jongg parlor, and an assortment of moon cakes, a Chinese delicacy. All this for $80 a night, about 20% less than the average cost of a room in Shanghai.

For travelers who associate the Sheraton brand with plastic ice buckets and polyester bedspreads in the United States, this may come as a surprise. Like Buick, Kentucky Fried Chicken (KFC), and Pizza Hut, Sheraton is one of those American names that, to some, seems past its prime at home, but it is still popular and growing abroad. The hotel brand has particular cachet in China, going back to 1985, when it opened the Great Wall Sheraton Hotel Beijing. Local developers still compete to partner with Sheraton’s parent company—Starwood Hotels & Resorts Worldwide—to develop new properties. In the near future, the company will have more rooms in Shanghai than it does in New York.

Like many other U.S. companies experiencing pressure at home, Starwood sees China as one of its best hopes for growth. The company, which also owns the upscale St. Regis, Westin, W, and Le Meridien brands, expects much of this growth will come from outlying regions. Big cities such as Beijing now have plenty of rooms, thanks in part to the Olympics, but there is growing demand for business-class accommodation in second- and third-tier cities such as Jiangyin and Dalian. Lower construction costs and inexpensive labor mean the company’s Chinese hotel owners can offer guests a lot more than comparably priced U.S. properties.

In recent years, the focus in China has shifted from international travelers to Chinese consumers. Starwood now asks its hotel staff to greet guests in Mandarin instead of English, which was long used to convey a sense of prestige. Many of its hotels do not label their fourth floors as such because four is considered an unlucky number.

Starwood is not alone in recognizing the potential of the Chinese market. Marriott International hopes to increase its China presence by 50%, to 61 hotels by 2014. And InterContinental Hotels Group, parent of Holiday Inn, plans to double the 118 hotels it has in China over the next 3 years.

One major perk Starwood can offer over local competitors is its extensive global network and loyalty perks. More than 40% of its Chinese business comes through its preferred-guest program, and Chinese membership in the program is increasing rapidly. But local customers are not particularly focused on accruing points to earn a free stay. They are more interested in “status,” using points to get room upgrades, a free breakfast, or anything that accords them conspicuous VIP treatment. Among other things, the preferred guest system allows staffers to see people’s titles immediately. That makes it easier to give better rooms to managers than the subordinates they are traveling with and to greet them first when a party arrives.

After a long period in which Starwood paid more attention to its hipper W and Westin brands, the company has recently been remodeling its U.S. Sheratons. Among mainland Chinese travelers, the Sheraton name has continued to exude an aura of international class. While that is helpful for Sheraton’s domestic Chinese business, the real potential will only be realized when they start to travel. The company’s goal is to lock in the loyalty of mainland customers so they will stay at a Sheraton when they travel abroad. Indeed, if the experience with Japanese tourists in the mid-1980s is any guide, Starwood could be looking at 100 million or more outbound trips from China.

Global message strategiesStrategies that use the same message worldwide but allow for local adaptation of the offer. use the same message worldwide but allow for local adaptation of the offer. McDonald’s, for example, is positioned virtually identical worldwide, but it serves vegetarian food in India and wine in France. The primary motivation behind this type of strategy is the enormous power behind a global brand. In industries in which customers increasingly develop similar expectations, aspirations, and values; in which customers are highly mobile; and in which the cost of product or service adaptation is fairly low, leveraging the global brand potential represented by one message worldwide often outweighs the possible disadvantages associated with factors such as higher local research and development (R&D) costs. As with global-offer strategies, however, global message strategies can be risky in the long run—global customers might not find elsewhere what they expect and regularly experience at home. This could lead to confusion or even alienation.

Minicase: KFC Abroadhttp://www.kfcbd.com/aboutus_kfcbang.htm

KFC is synonymous with chicken. It has to be because chicken is its flagship product. One of the more recent offers the company created—all around the world—is the marinated hot and crispy chicken that is “crrrrisp and crunchy on the outside, and soft and juicy on the inside.” In India, KFC offers a regular Pepsi with this at just 39 rupees. But KFC also made sure not to alienate the vegetarian community—in Bangalore, you can be vegetarian and yet eat at KFC. Why? Thirty-five percent of the Indian population is vegetarian, and in metros such as Delhi and Mumbai, the number is almost 50%. Therefore, KFC offers a wide range of vegetarian products, such as the tangy, lip-smacking Paneer Tikka Wrap ‘n Roll, Veg De-Lite Burger, Veg Crispy Burger. There are munchies such as the crisp golden veg fingers and crunchy golden fries served with tangy sauces. You can combine the veg fingers with steaming, peppery rice and a spice curry. The mayonnaise and sauces do not have egg in them.

While the vegetarian menu is unique to India because of the country’s distinct tastes, KFC’s “standard” chicken products are also adapted to suit local tastes. For example, chicken strips are served with a local sauce, or the sauce of the wrap is changed to local tastes. Thus, KFC tries to balance aggregation with adaptation: standardization of those parts of the value offering that travel easily (KFC’s core products and positioning), tailoring of standard chicken products with a different topping or sauce, and offering a vegetarian menu.

This adaptation strategy is used in every country that KFC serves: the U.S. and European markets have a traditional KFC menu based on chicken burgers and wraps, while Asian offerings like those in India are more experimental and adventurous and include rice meals, wraps, and culture-appropriate sides.

Global change strategiesStrategies that define a “best fit” approach to markets that require local adaptation of a firm’s value proposition and message. define a “best fit” approach and are by far the most common. As we have seen, for most products, some form of adaptation of both the offer and the message is necessary. Differences in a product’s usage patterns, benefits sought, brand image, competitive structures, distribution channels, and governmental and other regulations all dictate some form of local adaptation. Corporate factors also play a role. Companies that have achieved a global reach through acquisition, for example, often prefer to leverage local brand names, distribution systems, and suppliers rather than embark on a risky global one-size-fits-all approach. As the markets they serve and the company become more global, selective standardization of the message and the offer itself can become more attractive.

Minicase: Targeting Muslim CustomersPower (2009, June 1).

Muslims often experience culture shock while staying in Western hotels. Minibars, travelers in bikinis, and loud music, among other things, embarrass Muslim travelers.

That is no longer necessary. A growing number of hotels has started to cater to Muslim travelers. In one, the lobby—decorated in white leather, brick, and glass, with a small waterfall—is quiet. Men in dishdashas and veiled women mingle with Westerners who are sometimes discreetly reminded to respect local customs. Minibars are stocked not with alcohol but with Red Bull, Pepsi, and the malt drink Barbican.

“Buying Muslim” used to mean avoiding pork and alcohol and getting your meat from a halal butcher, who slaughtered in accordance with Islamic principles. But the halal food market has exploded in the past decade and is now worth an estimated $632 billion annually, according to the Halal Journal, a Kuala Lumpur–based magazine. That amounts to about 16% of the entire global food industry. Throw in the fast-growing Islam-friendly finance sector and the myriad of other products and services—cosmetics, real estate, hotels, fashion, insurance, for example—that comply with Islamic law and the teachings of the Koran, and the sector is worth well over $1 trillion a year.

Seeking to tap that huge market, multinationals like Tesco, McDonald’s, and Nestlé have expanded their Muslim-friendly offerings and now control an estimated 90% of the global halal market. Governments in Asia and the Middle East are pouring millions into efforts to become regional “halal hubs,” providing tailor-made manufacturing centers and “halal logistics”—systems to maintain product purity during shipping and storage. The intense competition has created some interesting partnerships in unusual places. Most of Saudi Arabia’s chicken is raised in Brazil, which means Brazilian suppliers had to build elaborate halal slaughtering facilities. Abattoirs in New Zealand, the world’s biggest exporter of halal lamb, have hosted delegations from Iran and Malaysia. And the Netherlands, keen to exploit Rotterdam’s role as Europe’s biggest port, has built halal warehouses so that imported halal goods are not stored next to pork or alcohol.

It is not just about food. Major drug companies now sell halal vitamins free of the gelatins and other animal derivatives that some Islamic scholars say make mainstream products haram, or unlawful. The Malaysia-based company Granulab produces synthetic bone-graft material to avoid using animal bone, while Malaysian and Cuban scientists are collaborating on a halal meningitis vaccine. For Muslim women concerned about skin-care products containing alcohol or lipsticks that use animal fats, a few cosmetics firms are creating halal makeup lines.

The growing Islamic finance industry is trying to win non-Muslim customers. Investors are attracted by Islamic banking’s more conservative approach: Islamic law forbids banks from charging interest (though customers pay fees), and many scholars discourage investment in excessively leveraged companies. Though it currently accounts for just 1% of the global market, the Islamic finance industry’s value is growing at around 15% a year, and it could reach $4 trillion in 5 years, according to a 2008 report from Moody’s Investors Service.

6.3 Combining Aggregation and Adaptation: Global Product Platforms

One way around the trade-off between creating global efficiencies and adapting to local requirements and preferences is to design a global product or communication platformA modularized approach to global product design that can be adapted efficiently to different markets. that can be adapted efficiently to different markets. This modularized approach to global product design has become particularly popular in the automobile industry. One of the first “world car platforms” was introduced by Ford in 1981. The Ford Escort was assembled simultaneously in three countries—the United States, Germany, and the United Kingdom—with parts produced in 10 countries. The U.S. and European models were distinctly different but shared standardized engines, transmissions, and ancillary systems for heating, air conditioning, wheels, and seats, thereby saving the company millions of dollars in engineering and development costs.

Minicase: Creating the Perfect Fit: New Car-Seat DesignBuss (2009).

Imagine the challenge of being an automotive-seat engineer these days, and picture one of the hugest men you know—a large, American male weighing about 275 lbs. Now consider a petite woman, and throw in someone with lower-back pain. Your challenge: design a single seat that comfortably accommodates each of these physically and physiologically diverse individuals, not just for a few minutes but for a 4-hour drive. Welcome to the global automotive design challenge.

While the economic pressures to standardize are becoming stronger, car buyers are getting more size-diverse, more ergonomically distressed, and more demanding of power adjustments and other amenities. Seat developers are responding: they are using more versatile materials, new engineering techniques, digital technologies, and novel designs to make sitting in a car as, or even more, comfortable as sitting in your living room.

This concern for comfort is relatively new; hard benches were the standard during the industry’s earliest days. Even into the 1980s, most cars and trucks had simple bench seating in both the front and rear of the automobile. Automotive seat design only became a crucial discipline during the last generation as Americans began to spend more and more time in their vehicles and as interior comfort and appointments became a major competitive issue.

Federal regulations affect seat design only minimally, with the most important requirements focusing on headrests. And there are distance requirements between the driver’s body and the steering wheel, an issue that can also be addressed with telescoping steering wheels and adjustable pedals. In the end, automakers must mainly make sure the seat design helps the car pass the government’s crash-safety standards.

Consumers are far more demanding. Comfort and ergonomic functionality have become the focal points of seat design. Americans are getting bigger and heavier, and automakers try to design seats that can accommodate everyone from the smallest females to the largest males. This is not a simple feat, with the 95th-percentile American man now weighing about 24 lbs more than 2 decades ago. At the same time, while U.S. women in general also have gotten larger, the influx of immigrants from Asia actually kept the overall increase in the size of the 5th-percentile American woman down to under 5 lbs over the last 2 decades.

And just as airlines and home-furniture manufacturers have had to respond to wider girths by making seats bigger, auto companies are also faced with having to squeeze bigger people into cabins that are getting smaller as gas prices rise. At the same time, seats must secure tiny drivers and allow them to see clearly over the steering wheel and reach the accelerator and brake pedals.

The aging of the American population poses special difficulties. Younger demographics like their seats harder, but baby boomers and older customers are used to a soft seat. Whether this is best ergonomically is not important, despite the fact that more and more consumers are carrying specific maladies of aging into their cars, including back pain, aching knees, and a general decline in the basic nimbleness required to get in and out of an automobile.

It is one thing to design a single seat that can accommodate the frames of the smallest to the largest Americans. Now add the globalization challenge. As automakers seek to globalize vehicle platforms, their seats also have to be able to accommodate the diverse body proportions, size ranges, and consumer preferences of people around the world.

For example, while Europeans definitely prefer longer cushions, and Asians like shorter ones, Americans are somewhere in between. And in China, the second row must be as comfortable as the first because as many as 40% of car owners have a driver, and the owners tend to sit in the right rear seat.

6.4 Combining Adaptation and Arbitrage: Global Product Development

Globalization pressures have changed the practice of product development (PD) in many industries in recent years.Eppinger and Chitkara (2006). Rather than using a centralized or local cross-functional model, companies are moving to a mode of global collaborationDescribes how skilled development teams that are dispersed around the world collaborate to develop new products. in which skilled development teams dispersed around the world collaborate to develop new products. Today, a majority of global corporations have engineering and development operations outside of their home region. China and India offer particularly attractive opportunities: Microsoft, Cisco, and Intel all have made major investments there.

The old model was based on the premise that colocationThe centralized location of cross-functional teams in corporate research and product development centers to facilitate their close collaboration with other organizational units. of cross-functional teams to facilitate close collaboration among engineering, marketing, manufacturing, and supply-chain functions was critical to effective product development. Colocated PD teams were thought to be more effective at concurrently executing the full range of activities involved, from understanding market and customer needs through conceptual and detailed design, testing, analysis, prototyping, manufacturing engineering, and technical product support and engineering. Such colocated concurrent practices were thought to result in better product designs, faster time to market, and lower-cost production. They were generally located in corporate research and development centers, which maintained linkages to manufacturing sites and sales offices around the world.

Today, best practice emphasizes a highly distributed, networked, and digitally supported development process. The resulting global product development process combines centralized functions with regionally distributed engineering and other development functions. It often involves outsourced engineering work as well as captive offshore engineering. The benefits of this distributed model include greater engineering efficiency (through utilization of lower-cost resources), access to technical expertise internationally, more global input to product design, and greater strategic flexibility.

6.5 Combining Aggregation, Adaptation, and Arbitrage: Global Innovation

Many companies now have global supply chains and product development processes, but few have developed effective global innovation capabilities.Santos, Doz, and Williamson (2004, Summer). Increasingly, however, technology access and innovation are becoming key global strategic driversCompetitive capabilities and factors required for a firm to compete effectively in global markets.. This move from cost to growth and innovation is likely to continue as the center of gravity of economic activity shifts further to the East.

To illustrate the significant advantages of a truly global innovation strategy, Santos and others cite the battle between Motorola, Inc. and Nokia Corporation in the cellular phone industry. Motorola was a pioneer in the technology, building on initial path-breaking research from Bell Laboratories. But by focusing primarily on U.S. customers and U.S. solutions, it missed the market shift toward digital mobile technology and the global system for mobile (GSM) communication, which became the standard in Europe. The company also failed to appreciate that consumers were rapidly developing different use patterns and preferences about product design, thereby rendering a one-size-fits-all strategy obsolete.

A core competency in global innovation—the ability to leverage new ideas all around the world—has become a major source of global competitive advantage, as companies such as Nokia, Airbus, SAP, and Starbucks demonstrate. They realize that the principal constraint on innovation “performance” is knowledge. Accessing a diverse set of sources of knowledge is therefore a key challenge and is critical to successful differentiation. Companies whose knowledge pool is the same as that of its competitors will likely develop uninspired “me, too” products; access to a diversity of knowledge allows a company to move beyond incremental innovation to attention-grabbing designs and breakthrough solutions.

There is an interesting relationship between geography and knowledge diversity. In Finland, for example, the high cost of installing and maintaining fixed telephone lines in isolated places has spurred advances in radiotelephony. In Germany, cultural and political factors have encouraged the growth of a strong “green movementA movement that promotes recycling and the use of renewable energy to conserve resources and protect the environment.,” which in turn has generated a distinctive market and technical knowledge in recycling and renewable energy. Just-in-time production systems were pioneered in part because of high land costs there. Recognition of the role played by geography in innovation has prompted many companies to globalize their perspective on the innovation process. For example, pharmaceutical companies such as Novartis AG and GlaxoSmithKline plc now realize that the knowledge they need extends far beyond traditional chemistry and therapeutics to include biotechnology and genetics. What is more, much of this new knowledge comes from sources other than the companies’ traditional R&D labs in Basel, Bristol, and in New Jersey, from places such as California, Tel Aviv, Cuba, or Singapore. For these companies, globalization of innovation processes is no longer optional—it has become imperative.

Companies that globalize their supply chains by accessing raw materials, components, or services from around the world are typically able to reduce the overall costs of their operations. Similarly, a side benefit of global innovation is cost reduction. Consider, for example, how companies are now leveraging software programmers in Bangalore, India, aerospace technologists in Russia, or chipset designers in China to cut the costs of their innovation processes.

To reap the benefits of global innovation, companies must do three things:

- Prospect (find the relevant pockets of knowledge from around the world)

- Assess (decide on the optimal “footprint” for a particular innovation)

- Mobilize (use cost-effective mechanisms to move distant knowledge without degrading itSantos, Doz, and Williamson (2004, Summer).

ProspectingInvolves finding valuable new pockets of knowledge to spur innovation.—that is, finding valuable new pockets of knowledge to spur innovation—may well be the most challenging task. The process involves knowing what to look for, where to look for it, and how to tap into a promising source. Santos and colleagues cite the efforts of the cosmetics maker Shiseido Co., Ltd., in entering the market for fragrance products. Based in Japan, a country with a very limited tradition of perfume use, Shiseido was initially unsure of the precise knowledge it needed to enter the fragrance business. But the company did know where to look for it. So it bought two exclusive beauty boutique chains in Paris, mainly as a way to experience, firsthand, the personal care demands of the most sophisticated customers of such products. It also hired the marketing manager of Yves Saint Laurent Parfums and built a plant in Gien, a town located in the French perfume “cluster.” France’s leadership in that industry made the where fairly obvious to Shiseido. The how had also become painfully clear because the company had previously flopped in its efforts to develop perfumes in Japan. Those failures convinced Shiseido executives that to access such complex knowledge—deeply rooted in local culture and combining customer information, aesthetics, and technology—the company had to immerse itself in the French environment and learn by doing. Having figured out the where and how, Shiseido would gradually learn what knowledge it needed to succeed in the perfume business.

AssessingIncorporating new knowledge into and optimizing an existing innovation network. new sources of innovation, that is, incorporating new knowledge into and optimizing an existing innovation network, is the second important challenge companies face. If a semiconductor manufacturer is developing a new chip set for mobile phones, for example, should it access technical and market knowledge from Silicon Valley, Austin, Hinschu, Seoul, Bangalore, Haifa, Helsinki, and Grenoble? Or should it restrict itself to just some of those sites? At first glance, determining the best footprint for innovation does not seem fundamentally different from the trade-offs companies face in optimizing their global supply chains: adding a new source might reduce the price or improve the quality of a required component, but more locations may also mean additional complexity and cost. Similarly, every time a company adds a source of knowledge to the innovation process, it might improve its chances of developing a novel product, but it also increases costs. Determining an optimal innovation footprint is more complicated, however, because the direct and indirect cost relationships are far more imprecise.

Mobilizing Integrating knowledge from different sources into a virtual melting pot from which new products or technologies can emerge.the footprint, that is, integrating knowledge from different sources into a virtual melting pot from which new products or technologies can emerge, is the third challenge. To accomplish this, companies must bring the various pieces of (technical) knowledge that are scattered around the world together and provide a suitable organizational form for innovation efforts to flourish. More importantly, they would have to add the more complex, contextual (market) knowledge to integrate the different pieces into an overall innovation blueprint.

Minicase: P&G’s Success in Trickle-Up Innovation: Vicks Cough Syrup With HoneyJana (2009, March 31).

A new over-the-counter medicine from Vicks that has recently become popular in Switzerland is not as new as it seems. The product, Vicks Cough Syrup with Honey, is really just the latest incarnation of a product that Vicks parent company, Procter & Gamble (P&G), initially created for lower-income consumers in Mexico and then “trickled up” to more affluent markets.

The term “trickle up” refers to a strategy of creating products for consumers in emerging markets and then repackaging them for developed-world customers. Until recently, affluent consumers in the United States and Western Europe could afford the latest and greatest in everything. Now, with purchasing power dramatically reduced because of the global recession, budget items once again make up a growing portion of total sales in many product categories.

P&G is not the only multinational company using this strategy. Other practitioners of trickle-up innovation include General Electric (GE), Nestlé, and Nokia. In early 2008, GE Healthcare launched the MAC 400, GE’s first portable Electrocardiograph (ECG) that was designed in India for the fast-growing local market there. The company simplified elements of its earlier, 65-lb devices made for U.S. hospitals by shrinking its case to the size of a fax machine and removing features such as the keyboard and screen. The smaller MAC 400 costs only $1,500, versus $15,000 for its U.S. predecessor. This trickle-down innovation trickled back up again when GE Healthcare decided to sell the unit in Germany as well.

Nestlé offers inexpensive instant noodles in India and Pakistan under its Maggi brand. The line includes dried noodles that are engineered to taste as if they were fried, while they have a whole-wheat flavor that is popular in South Asia. And Nokia researches how people in emerging nations share phones, such as the best-selling 1100 series of devices created for developing-world consumers. The company then uses the information as inspiration for new features for developed-world users.

But what is unique about P&G’s Honey Cough, as it is also called, is that it has moved around the globe in more than one direction. Honey Cough originated in 2003 in P&G’s labs in Caracas, Venezuela, which creates products for all of Latin America. Market research revealed that Latin American shoppers tended to prefer homeopathic remedies for coughs and colds, so P&G set out to create a medicine using natural honey rather than the artificial flavors typically used. The company first introduced the syrup in Mexico, under the label VickMiel, and then in other Latin American markets, including Brazil.

P&G deduced that the product would appeal to parts of the United States that have large Hispanic populations. In 2005, the company rebranded it as Vicks Casero for sale in California and Texas, at a price slightly less than Vicks’ mainstay product, Vicks Formula 44. Within the first year of its release, the company boosted distribution to 27% more outlets.

Figuring that natural ingredients could appeal to even wider groups, P&G took the product to other markets where research indicated that homeopathic cold medicines are popular. In the past 2 years, the company has been marketing the product in Britain, France, Germany, and Italy, as well as Switzerland, and plans to add other Western European countries to the roster.

And Western Europe is not the last destination for iterations of Honey Cough. If P&G’s current market research in the greater United States shows that mainstream American shoppers will buy Honey Cough, P&G will repackage it and market it nationwide, not just as Vicks Casero in Latino markets.

Developing and marketing a new product for each nation or ethnic group can take half a decade. Trickle-up innovation can reduce this time by several years, which explains its appeal. In each rollout, P&G has needed to do little more than make adjustments for each nation’s health regulations.

At a time when companies are looking to speed product offerings while dealing with shrinking budgets and cash-strapped consumers, P&G’s experience with its Honey Cough line shows how an international product portfolio can be tapped quickly and cheaply—that is, if American companies learn how to go against the flow.

6.6 Points to Remember

- Managers sometimes assume that what works in their home country will work just as well in another part of the world. The result in most cases is failure. Why? Because the assumption that one approach works everywhere fails to consider the complex mosaic of differences that exists between countries and cultures.

- With a few exceptions, the idea of an identical, fully standardized global value proposition is a myth, and few industries are truly global. How to adapt a value proposition in the most effective manner is therefore a key strategic issue.

- Value proposition adaptation deals with a whole range of issues, ranging from the quality and appearance of products to materials, processing, production equipment, packaging, and style.

- A useful construct for analyzing the need to adapt the product or service and message (positioning) dimensions is the value proposition globalization matrix.

- One way around the trade-off between creating global efficiencies and adapting to local requirements and preferences is to design a global product or communication platform that can be adapted efficiently to different markets.

- Globalization pressures have changed the practice of product development in many industries in recent years. Today, a majority of global corporations have engineering and development operations outside of their home region.

- Many companies now have global supply chains and product development processes but few have developed effective global innovation capabilities. Increasingly, however, technology access and innovation are becoming key global strategic drivers.

- A core competency in global innovation—the ability to leverage new ideas all around the world—has become a major source of global competitive advantage.