Chapter 4: Myths

Truths and Myths About Entrepreneurs

The late Jeffry Timmons, one of the early leaders in entrepreneurship education, noted that there are few truths about entrepreneurs but many myths. Among those truths, he said (LibreTexts, 2024):

Entrepreneurs work hard and are driven by an intense commitment and determined perseverance; they see the cup half full, rather than half empty; they strive for integrity; they burn with the competitive desire to excel and win; they are dissatisfied with the status quo and seek opportunities to improve almost any situation they encounter; they use failure as a tool for learning and eschew perfection in favor of effectiveness; and they believe they can personally make an enormous difference in the final outcome of their ventures and their lives.

The myths, however, are many. The following five entrepreneurship myths are among the most prevalent:

Myth 1: Entrepreneurs are born, not made.

The most prevalent myth about entrepreneurs is that they are born with the skills that will make them successful and that anyone who’s not born with those skills will not succeed. In reality, entrepreneurism is a skill that, like any other skill, can be learned (Heyward, 2022).

The question of whether successful entrepreneurs are born or made has long intrigued scholars and industry experts. While some believe figures like Elon Musk have an innate advantage, others argue that entrepreneurial success is not genetically predetermined. The consensus here is that entrepreneurs are made through a series of good decisions, hard work, education, and experience, rather than being born with an innate ability.

Innovation is a crucial factor in entrepreneurial success. Good entrepreneurs identify problems and offer innovative solutions, a skill that is nurtured rather than inherent. Innovation keeps businesses relevant and competitive, as seen with companies like Apple, which continuously releases new products to meet consumer expectations. Without constant innovation, businesses risk stagnation and failure.

Experience also plays a significant role in distinguishing successful entrepreneurs. Learning from past experiences and mistakes helps entrepreneurs better navigate future challenges. Whether gained through previous employment, mentorship, or trial and error, experience teaches valuable lessons that contribute to sustained business success. Successful entrepreneurs are adept at turning mistakes into learning opportunities, allowing them to refine their strategies and avoid repeating errors.

Myth 2: Entrepreneurs make more money.

Entrepreneurship offers the potential for unlimited profitability, unlike the fixed salary of a full-time job. By owning a business, entrepreneurs can create their own value and retain profits after covering operational costs, with the possibility of a significant payout if the business is sold. However, this path to wealth is not straightforward and varies widely among individuals (Bova, 2017).

Surprisingly, the typical entrepreneur earns less than that if they were working as employees. Only the top 10 percent of entrepreneurs earn more than employees (Shane, 2008).

Read more about this in the following Guy Kawasaki article: Top Ten Myths of Entrepreneurship

A study by American Express OPEN found that over half of entrepreneurs pay themselves a full-time salary, averaging around $68,000 a year, which is above the median household income in the US at $52,000. This salary does not account for additional profits or earnings from selling the business, providing a general picture of an entrepreneur’s financial performance.

While society often highlights the few entrepreneurs who achieve multi-billion-dollar success, this level of achievement is rare among the 28 million small business owners in the United States. Although becoming extraordinarily wealthy is possible, it is not the norm, and most entrepreneurs earn a more modest income.

Myth 3: Being original is essential.

Another entrepreneurial myth is that entrepreneurs who get to the market first gain the most (Suarez, 2008).

A first-mover advantage can be simply defined as a firm’s ability to be better off than its competitors as a result of being first to market in a new product category. For every study proving that first-mover advantages exist, there is a study proving they do not. Research by Joe Tabet has shown that the so-called first mover advantage is a myth. Google, eBay, and Swatch are examples of successful businesses that entered markets later(Debunking Myths about Entrepreneurs, 2009). For example, Google wasn’t the first search engine, and Facebook wasn’t the first social media platform. If these entrepreneurs would have stopped pursuing their idea because it wasn’t original, then we wouldn’t have these two large companies, which are just two examples of many.

The key, Tabet says, is to find your niche and serve your customers well. Finding gaps and being better than competitors can lead to success (Bova, 2015).

Myth 4: It takes a lot of money to start a business.

Research by Scott Shane of Case Western Reserve University has shown that the average new business needs only $25,000 in financing and that most of that money can be raised through debt. The Kauffman Foundations study states $30,000 is needed in financing, with costs rising each year. The cost of starting a business can vary greatly depending on the industry. For example, a manufacturing company with high equipment costs may cost more money than a service-based marketing business.

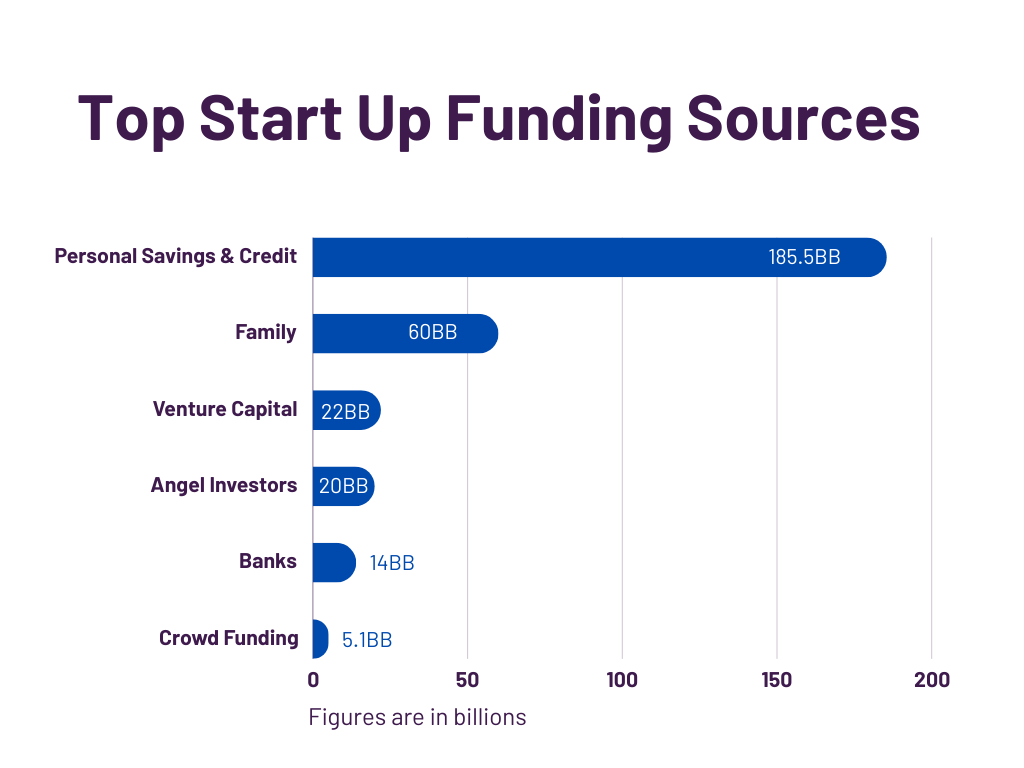

Governments and organizations like the Small Business Administration help businesses secure funding. According to the SBA, business financing comes from either internal financing (family, friends, or personal savings) or external financing (bank loans). See Figure 4.1 for a breakdown of funding sources for start-ups.

According to census data, about 68% of small businesses applied for new credit from banks in 2020. These businesses heavily depend on banks for their credit needs, but that means that 32% did not (U.S. Small Business Administration, 2023).

Ramsey Solutions shares information on how to start a business debt free:

For entrepreneurs who don’t want to pursue loans and debt, bootstrapping could be an option. Bootstrapping is the practice of self-financing a business using its own capital, either through the entrepreneur’s personal funds or the company’s earnings (Miller, 2022). This method offers autonomy and control, allowing entrepreneurs to maintain equity and make major decisions without needing approval from outside investors. Additionally, bootstrapping can simplify future capital structuring if external investment is sought later and eliminates the burden of repaying high-interest loans. However, bootstrapping also presents challenges, such as slower initial growth, increased financial risk for the entrepreneur, and difficulties in securing and managing sufficient capital to maintain steady cash flow.

Myth 5: Entrepreneurs must be risk takers.

The myth that entrepreneurs are inherently risk-takers is widely accepted but fundamentally flawed and potentially harmful(Cornwall, 2009). This misconception not only encourages bad habits among aspiring entrepreneurs but also deters risk-averse individuals from pursuing entrepreneurship. Consequently, this can result in fewer job creators, stifled innovation, and unresolved universal problems. Contrary to popular belief, many successful entrepreneurs focus on eliminating risk rather than embracing it. This perspective highlights that entrepreneurship is suitable for those who prefer certainty and careful planning over taking bold risks (George, 2022).

According to this myth, entrepreneurs are good at starting businesses but can’t manage them once they grow. Research by Babson College Professor Joel Shulman shows that the stocks of publicly traded companies run by entrepreneurs significantly outperform those run by non-entrepreneurs and continue to do so even after adjusting by market cap size, sector, geography, or time period.

Industry Example

Dr. Eric George, the founder and CEO of ERG Enterprises, shares his journey to entrepreneurship that was not without risk:

My path to becoming an entrepreneur didn’t follow convention. I became a hand surgeon and spent the first decade of my career building my practice. A fellow surgeon offered to sell me his business after he became terminally ill. The business was profitable, yet it struggled to recruit enough physicians. I had long recognized the problem and identified a variety of solutions, which I had voiced. I knew the business intimately, understood the market, and recognized the potential of the opportunity (both good and bad). So, I negotiated and accepted the offer. I bought the hospital with 12 other physicians and took over as CEO. Within months, we began generating significant profits.

To be clear, risk did factor into my calculus. In fact, it consumed my consideration. I devoted enough attention to vetting risk that I could account for all the factors that reinforced and mitigated it. I devoted myself to the process of “risk evaluation,” a crucial discipline I would argue all successful entrepreneurs apply. I’ve found that for those outside the profession, many tend to disassociate risk analysis and entrepreneurs. Thus, they assume entrepreneurship is only fitting for those with an idea and the bravery to bring it to fruition.

To foster more successful entrepreneurs, it’s essential to redefine entrepreneurship as a discipline that values risk elimination and careful planning. Aspiring entrepreneurs should focus on thorough risk analysis, understanding their markets deeply and developing strategies to mitigate potential risks. By doing so, they can increase their chances of success and contribute to innovation and job creation without being deterred by the fear of risk.

Pause and Reflect

- Of the myths listed above, which surprises you the most and why?

- What are some other myths that should be added to this list? How would you debunk them?

Key Takeaways

- The most prevalent myth about entrepreneurs is that they are born with the skills that will make them successful and that anyone who’s not born with those skills will not succeed. In reality, entrepreneurism is a skill that, like any other skill, can be learned.

- Entrepreneurial skills can be learned through education, experience, and good decisions.

- While entrepreneurship offers potential for high profits, typical entrepreneurs often earn less than employees.

- Success doesn’t require being first to market; many successful businesses entered markets later.

- Funding sources include personal savings, family, friends, and bank loans. Bootstrapping, or self-financing, offers autonomy and control but poses challenges like slower growth and financial risk.

- Many successful entrepreneurs focus on eliminating and managing risk rather than embracing it. The misconception that entrepreneurship suits only risk-takers can deter potential founders.

A firm's ability to be better off than its competitors as a result of being first to market in a new product category.

This is the practice of self-financing a business using its own capital, either through the entrepreneur's personal funds or the company's earnings.